Will Tech Stocks Soar (Again) or Stall in 2025?

Innovation appears poised to continue amazing all of us in the New Year, but the macro-environment may become far less hospitable for tech investors.

During the last decade, it has been a losing proposition betting against technology stocks. Large cap technology has outpaced the S&P 500 index in 9 of the last 10 years, besting the overall stock market by double-digits in almost 4 of the last 6 six years, and only suffering a single year of “underperformance” during the 2022 bear market. In the last decade, Big Tech has given investors a 22.4% average annualized total return and during the last five years – despite the 2022 bear market – Tech has still delivered an even more impressive 24.5% average annualized total return. Spectacular!

Mostly, the reason for this unbelievably consistent and outsized performance is the unprecedented world-changing innovation championed by the companies comprising this sector. How can the product offerings of utilities, consumer staples, industrial manufacturers, and even the latest retail trends compete for investor attention with the likes of AI, robotics, commercial space travel, and quantum computing?

While the tailwind of innovation exhibited by Tech companies is not likely to end anytime soon, there is another factor – the character of the macro-economic environment -- which has also played a contributory role in Tech’s dramatic performance during the last several years. Admittedly, the character of the economy has proved far less important for the technology sector than the magnitude of innovation, but it is something Tech investors should consider.

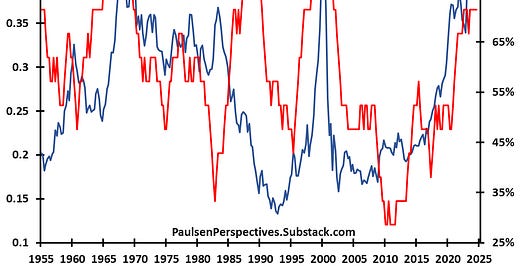

During the last decade, and particularly in the last five years, the pace of overall real GDP growth and the movement in bond yields have been very supportive for technology stocks. During the post-war era, Tech stocks have done best when real GDP growth was in its top three quintiles and when yields were climbing rather than falling. During the last decade and particularly since the 2020 pandemic, the macro environment of solid real GDP growth and mostly rising yields has been very supportive for technology stocks.

Nobody knows how 2025 will turn out. Innovation appears poised to continue amazing all of us in the New Year, but the macro-environment may become far less hospitable for tech investors. I suspect real GDP growth may slow to about 2% or less and for bond yields to decline during the year. Could a combo of subpar economic growth and falling yields bring a rare year of underperformance for Tech investors?

Keep reading with a 7-day free trial

Subscribe to Paulsen Perspectives to keep reading this post and get 7 days of free access to the full post archives.