Evidence of an Economic Slowdown Broadens

Several economic & stock market Indicators are now suggesting a meaningful slowdown in real GDP growth during 2025. What does this imply for the stock market?

The Federal Reserve recently slowed its easing campaign because of concerns the pace of economic growth remains too strong, and inflation may again be lifting. Bond investors ostensibly have similar worries as the 10-year Treasury Yield surged to 4.63% last week. Although policy officials and investors appear increasingly anxious about the potential for overheated economic growth, I think the more likely outcome for 2025 is an unexpected economic slowdown.

Lagged Impact of Economic Policies Pointing to Weaker Economic Growth

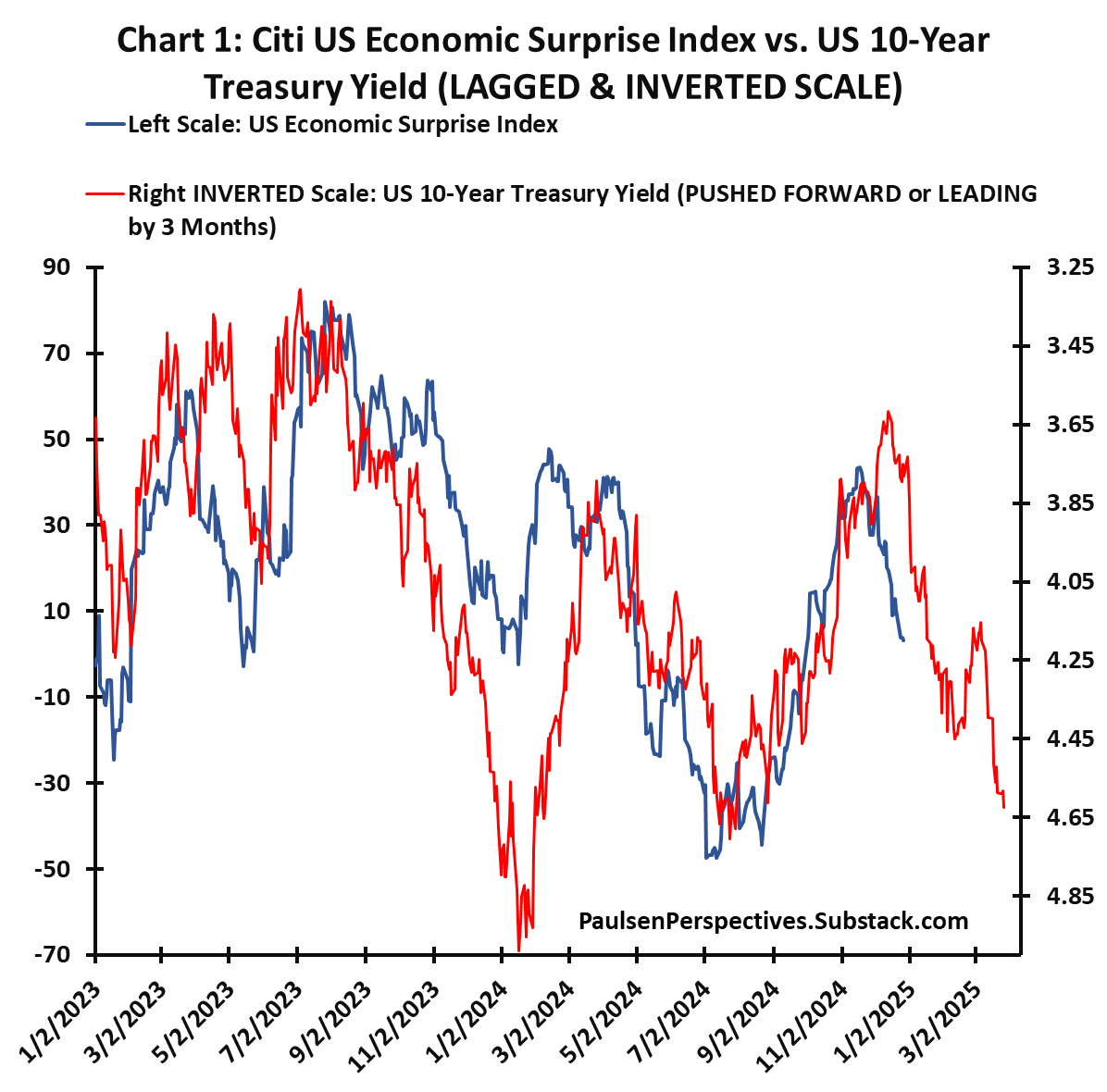

As shown in chart 1, the U.S. economic surprise index (shown in blue) has already moderated significantly in recent weeks declining from a high of about 45 in mid-November to about 3 last Friday. The Citi Economic Surprise Index measures economic releases during the month relative to market expectations. A rise in this index means economic reports have been stronger than expected while declines indicate that economic momentum is trending weaker than expected.

Keep reading with a 7-day free trial

Subscribe to Paulsen Perspectives to keep reading this post and get 7 days of free access to the full post archives.